How we regulate financial sustainability within higher education

Monitoring financial performance

We collect financial data and information from individual providers. This includes audited financial statements, financial and student recruitment forecasts, and a commentary to explain these.

We gather intelligence from conversations with representative bodies, the sector’s lenders and other organisations. We have also added a series of roundtables with providers’ finance directors to our annual activities to discuss the risks facing providers and the sector.

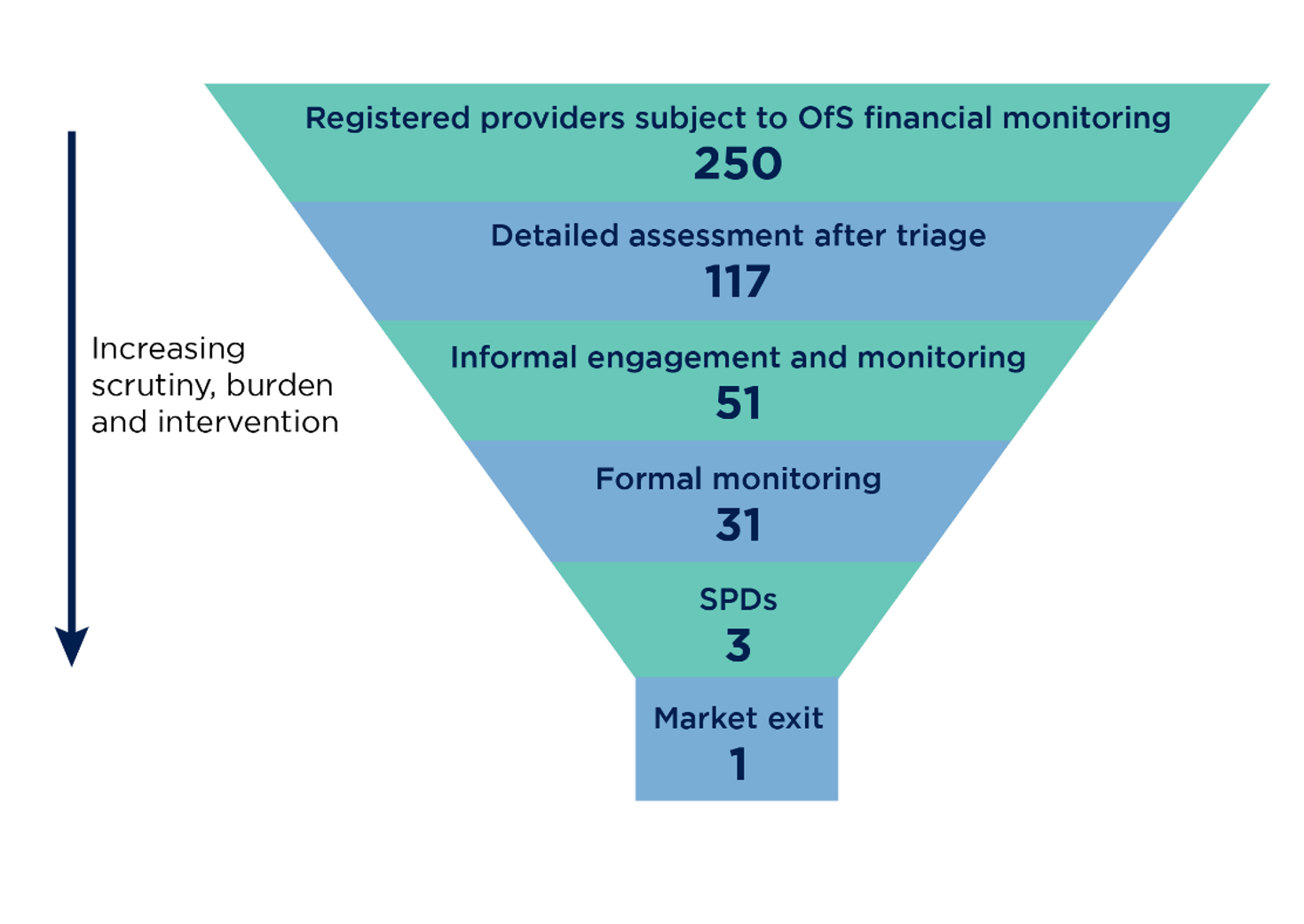

Our risk-based approach means that we go through different stages of monitoring depending on our judgement about risk, filtering out providers at each stage. As we move through the stages, or down the funnel, a provider will be subject to greater scrutiny or intervention.

Higher education providers at each monitoring stage (return for 2021)

- The numbers in the funnel in this diagram exclude further education and sixth form colleges, which submit financial information to the Education and Skills Funding Agency.

- ‘Formal monitoring’ represents providers subject to additional monitoring requirements. This includes:

- providers subject to more extensive or more frequent bespoke reporting requirements

- providers we have flagged for a review of a particular issue on a more frequent or more detailed basis

- providers subject to a student protection direction (SPD) on the basis set out in condition C4.

- The funnel shows the total number of SPDs and market exits since the OfS introduced SPDs in condition C4 in April 2021.

- The numbers in the funnel represent a snapshot of the number of providers in each stage. These numbers change during the annual cycle as we receive information from providers and complete our assessments.

We take a risk-based approach to assessing individual providers’ financial sustainability, drawing on our understanding of the risks that may affect a broad range of providers.

This is not a full list but it gives an idea of the type of risks that may affect financial sustainability.

- A provider’s financial model

A provider’s financial model could pose risks to its financial sustainability. For example, it could rely on international student recruitment, which may pose a risk if it is recruiting many students from one country. - Impact of inflation

Providers have faced significant increases in inflation, like many other organisations in the economy, but they have less flexibility to raise their income through fees and other charges. - Sustainability of pension schemes

Protecting the sustainability of pensions schemes for a provider’s previous and current workforce requires higher contributions from many employers and employees. - Investment in facilities and environmental policies

A provider may face financial challenges in maintaining sufficient levels of investment in high quality buildings and facilities and in meeting environmental targets. - Cost of living

Increasing living costs that affect students and staff may affect recruitment and increase the burden of recruitment and investment in support activities to retain students and staff.

In isolation these risks may challenge different providers to different degrees. A more challenging outlook may emerge if a provider faces them in combination.

Our risk-based approach to monitoring includes assessing providers that could face one of more of the risks we have identified.

We undertake a triage process to identify individual providers that need more detailed assessment. This involves considering a provider's financial performance, position and forecast information.

We identify providers for further assessment on the basis of risk factors. We use the information we receive in the annual financial return to construct financial and non-financial indicators that show:

- the provider’s ability to forecast accurately in previous years

- whether a provider is dependent on third-party support

- the percentage change in student numbers and providers with small student numbers

- the provider’s year end and lowest cash balances and the number of days that cash balance would allow it to pay its bills for

- ability to generate cash from its operations

- balance sheet strength

- the provider’s borrowing as a percentage of income.

We also consider our latest assessment of a provider’s financial risk, including any intelligence to suggest increased risk such as contained in reportable events or notifications submitted to the OfS.

If a provider is not identified for further assessment as a result of the triage process, it will hear nothing further from us once it has submitted a full set of data.

We assess the financial performance and position of each provider identified through the triage process. In addition to the indicators considered at that stage, we consider in more detail:

- compliance with the requirements of the annual financial return and quality of commentary

- historic financial performance and trends

- credibility of its forecasts

- income, expenditure and surplus or deficits

- levels of borrowing and likelihood of breaching bank covenants

- any third-party deed of undertaking and the financial health of the third-party

- independent auditors’ opinion in financial statements including ‘going concern’

- intelligence highlighting potential concerns with management and governance arrangements

- behaviours that indicate compliance or non-compliance set out in the regulatory framework.

We overlay the risks facing the sector, and how they apply to a particular provider in isolation and in combination.

We analyse the provider’s plans, forecasts and the degree of uncertainty and risk relating to its future position. We are particularly interested in the risk mitigations it has in place, or could put in place, and any scenario planning it has undertaken.

Our analysis determines whether we need to engage with a provider. In many cases our more detailed assessment will mean that this is not necessary.

Following detailed assessment, we may decide to engage informally with a provider to gather more information about its financial performance and position and begin a dialogue about any issues.

We may engage on a wide range of issues to get a better understanding of the risks a provider is facing, including:

- confirmation of progress towards student recruitment targets

- financial mitigations in place, such as details of revolving credit facilities and/or overdrafts or the status of third-party financial support

- likelihood of breaching banking covenants

- details of ‘emphasis of matter’, ‘material uncertainty’ or ‘going concern’ issues raised by auditors in audited financial statements

- repayment of loans and/or likelihood of renegotiation

- capital expenditure plans

- pension liabilities and provision.

We may also contact a provider to clarify:

- the assumptions it has made about how it will deliver its financial forecasts and the risks it has identified

- whether the provider has undertaken any scenario planning and if this covered the key risks.

We may also request additional financial information, such as updated forecasts.

We adopt a formal monitoring and engagement approach when we judge a provider to be at increased financial risk.

This may include more frequent engagement or the requirement of more detailed information, through an F3 Notice or, where appropriate, specific conditions of registration or student protection directions.

This could include:

- requiring a provider to submit regular management accounts, or forecasts of cashflow and lowest cash balances

- monitoring the likelihood of breaches of banking covenants

- requiring plans for rationalisation or restructuring

- engaging with a provider’s auditors

- discussing requirements for student protection planning.

This activity allows us to understand in more detail the nature of the risks faced by a provider and consider what further interventions might be appropriate.

It also encourages a provider to take seriously the need to mitigate the risks it is facing and consider planning for scenarios in which market exit is a credible outcome.

Condition C4: student protection directions enables us to intervene quickly and in a targeted way when there is a material risk that a registered provider may cease the provision of higher education.

We can require a provider to undertake planning for a potential market exit to protect student interests. Market exit plans can include arrangements for:

- teach out: ensuring students can complete their course and achieve the qualification that could reasonably have been expected, or complete their current academic year or term and receive an exit award or credit to recognise their academic achievement at the provider

- student transfer: supporting students to transfer to another higher education provider to continue and complete their studies

- exit awards and certification: providing students with a formal record of their achievement

- information, advice and guidance for students who may be affected by a market exit

- processes for complaints, refunds and compensation

- archiving arrangements: storing students’ work so they can access it in the future.

We aim to ensure providers focus on protecting the interests of current and future students when faced with a material risk of market exit.

We expect them to put plans in place in relation to the future options for students and ensure sufficient resources are available to deliver this. This includes considering and planning for how students can continue their studies, if they choose to, with minimal disruption.

When a market exit does happen we aim to ensure it is as orderly as possible from the perspective of the provider’s students.

We expect that in a competitive higher education market, providers will enter and leave the sector. We seek to ensure that any exits are as orderly as possible and to minimise the negative impact of an exit on students.

When it appears that an exit is likely to happen we can require a provider to deploy the student protection measures it has developed.

We may also engage with a range of other organisations, including the Department for Education, Student Loans Company, Office of the Independent Adjudicator for Higher Education, insolvency practitioners and the provider’s validators to deliver the best possible outcomes for students.

We have published case studies of potential market exit cases. The case studies show how we have used student protection directions and other regulatory tools to provide a basis for an orderly market exit to protect the interests of students at providers facing significant financial challenges.

We have a key performance measure to show the proportion of students who go on to further study when a provider exits the market.

Describe your experience of using this website